Table of Contents

- GitHub - oswaldo89/Vix-Challenge

- Vix App: Everything You Need To Know About The Streaming Service

- ViX: Cómo instalar y descargar la aplicación de forma sencilla

- Vix — VIX och Fear & Greed-index svalnar – riskviljan ökar

- VIX index explained - What do VIX values mean?

- VIXY: Huge Bets Have Been Placed On The VIX, But We Are Sticking To Our ...

- How to watch ViX in Canada [March 2025]

- Chỉ số biến động CBOE (VIX): Đo lường điều gì trong đầu tư? (CBOE ...

- Historical VIX Index Charts - VIXFAQ.com

- ViX logo displayed on a phone screen and ViX logo displayed on a ...

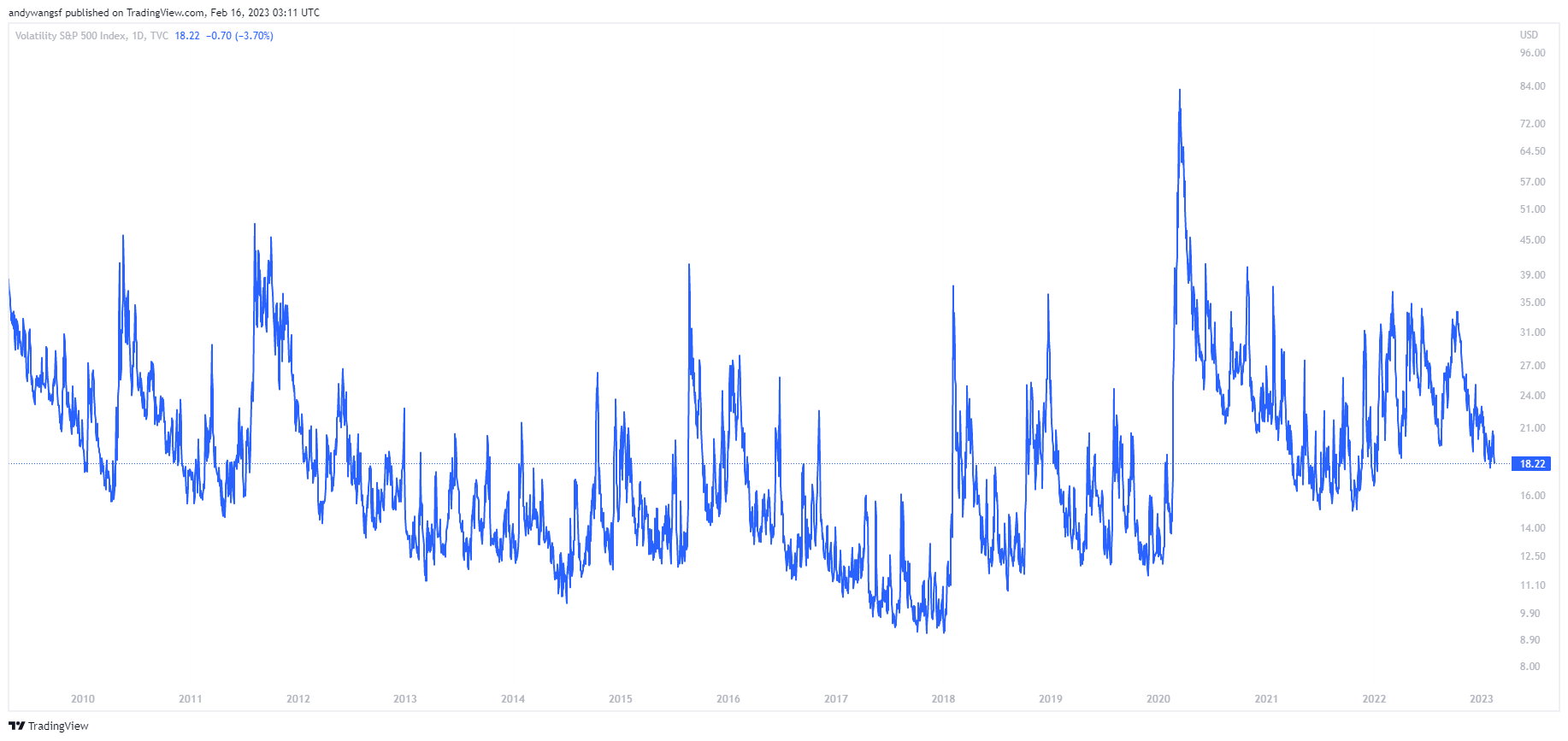

What is the VIX?

![How to watch ViX in Canada [March 2025]](https://www.purevpn.com/wp-content/uploads/2023/05/ViX-outside-US.png)

:max_bytes(150000):strip_icc()/VIX-38fed12f2f0e47a2a67133e4458a91e6.jpg)

How is the VIX Calculated?

Why is the VIX Important?

The VIX is an important tool for investors because it provides a way to measure market volatility and make more informed investment decisions. When the VIX is high, it can indicate that investors are fearful or uncertain about the market, which can lead to increased market volatility. Conversely, when the VIX is low, it can indicate that investors are more confident, which can lead to decreased market volatility.How to Use the VIX in Your Investment Strategy

The VIX can be used in a variety of ways to inform investment decisions. For example, investors can use the VIX to: Time market entries and exits: By monitoring the VIX, investors can time their entries and exits from the market to coincide with periods of low volatility. Adjust portfolio allocations: The VIX can be used to adjust portfolio allocations to reduce risk during periods of high volatility. Identify trading opportunities: The VIX can be used to identify trading opportunities, such as buying call options during periods of low volatility or selling put options during periods of high volatility. In conclusion, the VIX is a widely followed indicator of market volatility that provides a way to measure the expected volatility of the S&P 500 Index over the next 30 days. By understanding how the VIX works and how to use it in your investment strategy, you can make more informed investment decisions and potentially reduce your risk. Whether you are a seasoned investor or just starting out, the VIX is an important tool to have in your toolkit.For more information on the VIX and how to use it in your investment strategy, visit Fidelity Investments. With a wide range of investment products and services, Fidelity can help you achieve your financial goals.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.