Table of Contents

- Did Your Tax Return Get Accepted Before the IRS Opening Day in 2024? ⋆ ...

- NEW 2024 TAX RETURN UPDATE (FEBRUARY 22): ALL 50 STATES NEW REFUNDS ...

- 2024 Threshold For Net Investment Income Tax Return - Nedda Viviyan

- IRS ERRORS DEPARTMENT why you are still waiting on YOUR 2024 TAX ...

- How to file tax return 2024 | income tax return 2024 | Iris 2.0 - YouTube

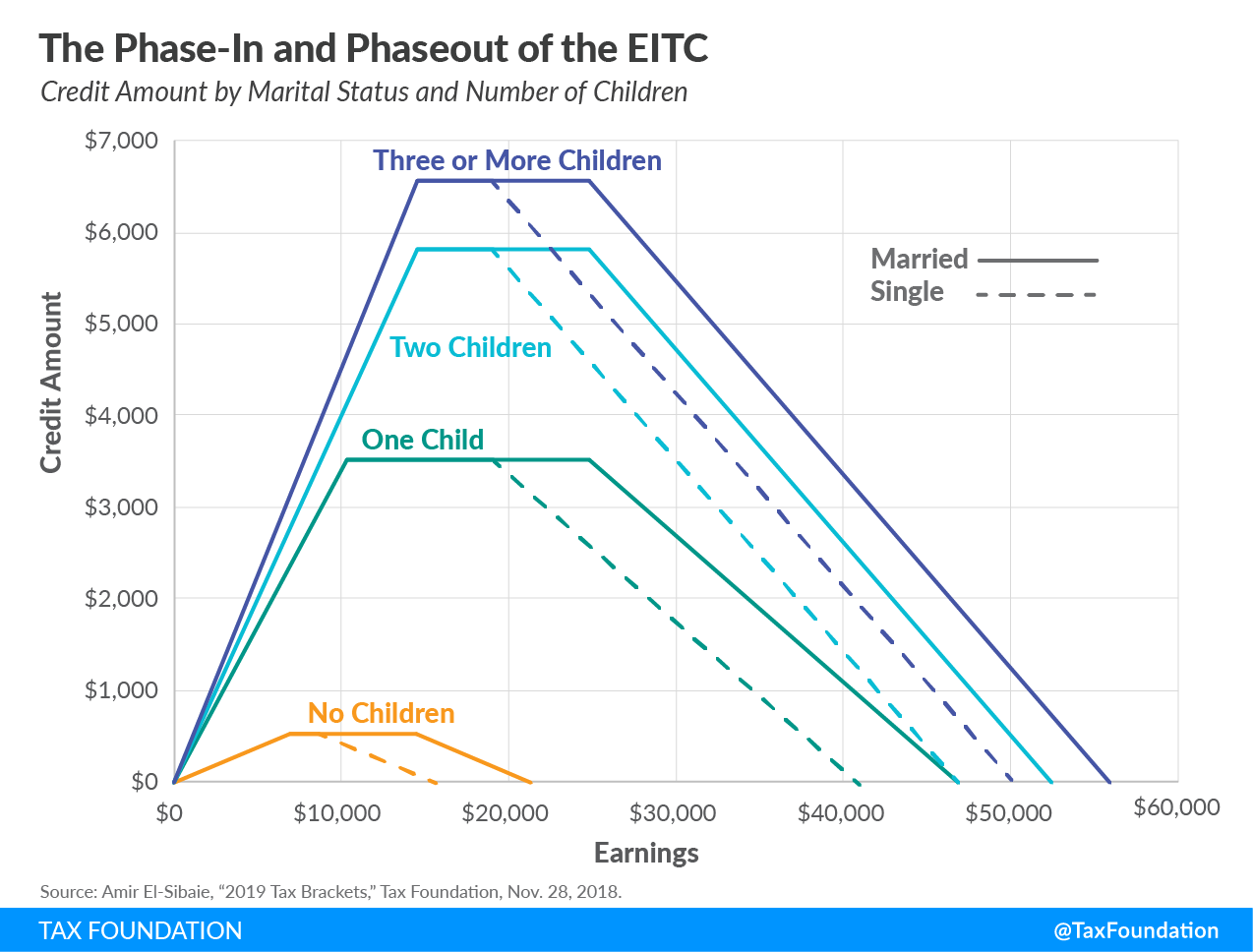

- Irs Eitc 2024 - Agnese Krissy

- IRS 2024 TAX REFUND UPDATE-2023 TAX RETURN PROCESSING-EITC Filers next ...

- Income Tax Return AY 2024-25: ITR-1, ITR-2, ITR-4 Enabled for Online ...

- TODAY is D Day: 2024 tax return deadline

- IRS CONFIRMS!! DON’T WAIT… 2024 Retroactive Tax Credits FILE NOW - YouTube

When Will the IRS Accept 2024 Returns?

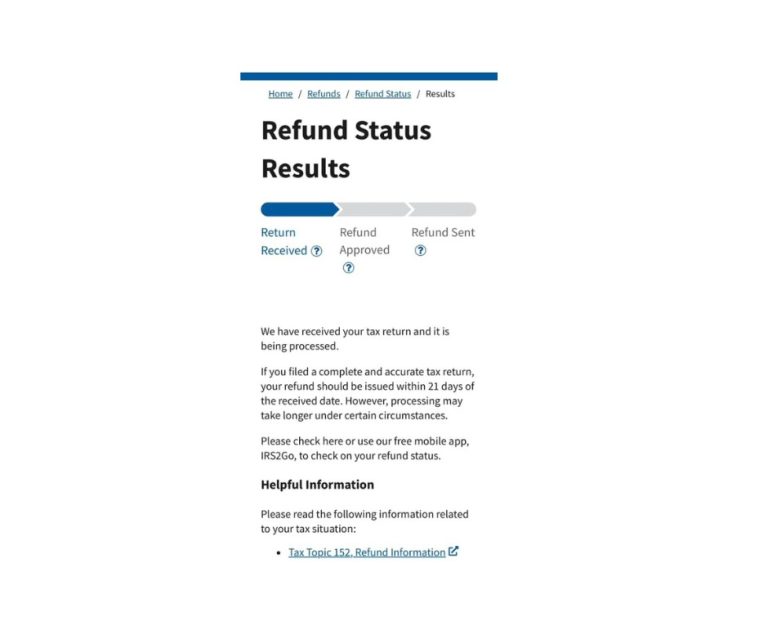

What to Expect During the Filing Process

Preparation is Key

To ensure a smooth and stress-free filing experience, it's essential to prepare your tax documents in advance. Here are a few tips to help you get started: Gather necessary documents: Collect all relevant tax documents, including W-2s, 1099s, and receipts for deductions. Choose a filing method: Decide whether you'll e-file or paper file your return, and choose a tax preparation method that suits your needs. Check for updates: Stay informed about any changes to tax laws or regulations that may affect your return. The IRS has announced that the 2024 tax filing season will begin on January 29, 2024. By understanding the filing process and preparing your tax documents in advance, you can ensure a smooth and stress-free experience. Remember to check the official IRS website for any updates or announcements, and take advantage of the Free File program if you're eligible. Don't wait until the last minute – mark your calendars and get ready to file your 2024 tax return.Keyword density: IRS (7), tax filing (5), 2024 tax returns (4), e-filing (2), Free File (2), refund (1), tax preparation (1), tax documents (2)

Meta description: Learn when the IRS will accept 2024 tax returns and what to expect during the filing process. Get tips on preparation and stay informed about any changes to tax laws or regulations.

Header tags: H1, H2

Image suggestions: IRS logo, tax forms, calendar, clock