Table of Contents

- Top 5 BEST REITs for 2024! | Dividend Investing - YouTube

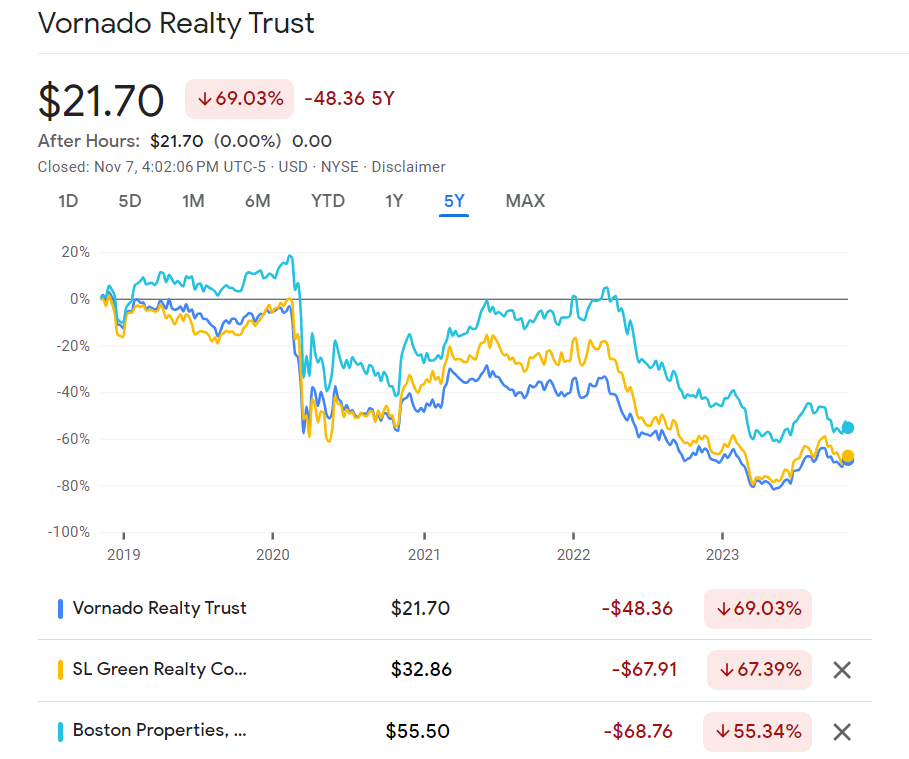

- Checking on 3 Top Office REITs | TopForeignStocks.com

- The Best 3 REITS to BUY in 2024 for Dividend Growth Investors - YouTube

- REIT Investments in India - Random Dimes

- Top REITs for March 2021

- Top 5 Hotel REITs to Consider in 2025

- What Are The Top REITs For 2025? | Seeking Alpha

- 2024 Top REITs High dividend paying in the Philippines - YouTube

- Top REITs To Buy For 2021 | Seeking Alpha

- The Best REITs for Every Investor - SlashTraders

:max_bytes(150000):strip_icc()/GettyImages-960287192-28108b63c00941988a6890e321c2c1e2.jpg)

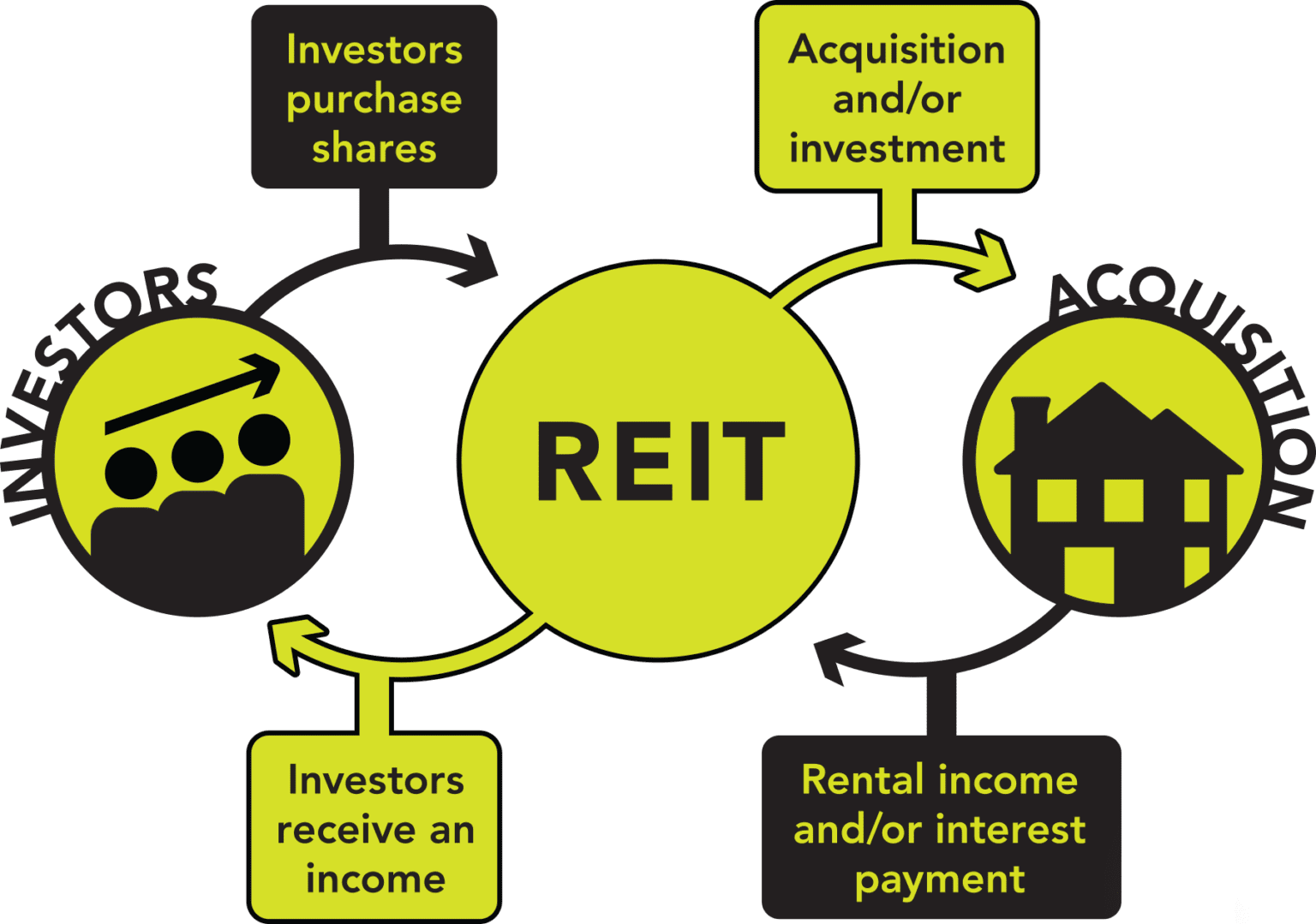

What are REITs?

Benefits of Investing in REITs

Top REITs to Consider

According to Kiplinger, the following REITs are among the best to buy: Realty Income (O): A retail REIT with a diverse portfolio of properties, including commercial and industrial buildings. National Retail Properties (NNN): A retail REIT with a focus on single-tenant properties, such as restaurants and convenience stores. Simon Property Group (SPG): A retail REIT with a portfolio of high-end shopping malls and outlet centers. Welltower (WELL): A healthcare REIT with a focus on medical office buildings, outpatient facilities, and senior housing. Equity Residential (EQR): A residential REIT with a portfolio of apartments and condominiums. Investing in REITs can be a great way to generate passive income and diversify your portfolio. By considering the top REITs recommended by Kiplinger, you can make informed investment decisions and potentially achieve your financial goals. Remember to always conduct your own research and consult with a financial advisor before making any investment decisions. With the right strategy and a solid understanding of the benefits and risks of REITs, you can build a strong and profitable investment portfolio.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.