Table of Contents

- TLT: Guide To The iShares 20+ Years Treasury Bond ETF ...

- TLT Stock Fund Price and Chart — NASDAQ:TLT — TradingView

- Ishares 20+ Year Treasury Bond ETF Trade Ideas — NASDAQ:TLT — TradingView

- Ishares 20+ Year Treasury Bond ETF Trade Ideas — NASDAQ:TLT — TradingView

- The 20 year Treasury Bond versus the TLT ETF - Which is better for ...

- TLT – iShares 20+ Year Treasury Bond ETF 美國長期公債ETF – FinTastic.Trading

- TLT: A Look At The Fundamentals (NASDAQ:TLT) | Seeking Alpha

- TLT Stock Price and Chart — TradingView

- Ishares 20 Year Treasury Bond ETF (TLT) | Technical Analysis. - YouTube

- 미국 장기 채권 투자 ETF TLT (iShares 20+ Year Treasury Bond ETF) 소개, 구성 종목, 배당 ...

What is TLT ETF?

Benefits of Investing in TLT ETF

TLT Stock Price and Quote

The TLT stock price and quote can be found on major financial websites, such as Yahoo Finance or Google Finance. The current price of TLT is around $140, with a 52-week range of $120 to $160. The ETF has a dividend yield of around 2.5% and an expense ratio of 0.15%.

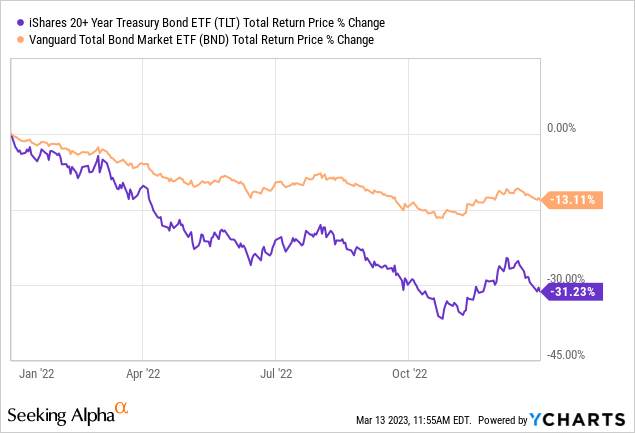

News and Market Trends

The TLT ETF is closely tied to the overall performance of the U.S. economy and interest rates. When interest rates rise, the price of TLT tends to fall, and when interest rates fall, the price of TLT tends to rise. Recently, the Federal Reserve has been raising interest rates, which has put downward pressure on the price of TLT. However, with the current economic uncertainty, some investors are seeking safe-haven assets like TLT. In conclusion, the iShares 20+ Year Treasury Bond ETF (TLT) is a low-risk investment option that provides regular income and diversification benefits. With its low expense ratio and high liquidity, TLT is an attractive option for investors looking to add a safe-haven asset to their portfolio. Whether you're a seasoned investor or just starting out, TLT is definitely worth considering. So why not take a closer look at TLT today and see how it can help you achieve your investment goals?For more information on TLT ETF, including the latest stock price and quote, news, and market trends, please visit our website or consult with a financial advisor.

Keyword density: TLT: 9 instances iShares 20+ Year Treasury Bond ETF: 3 instances Long-term Treasury bonds: 2 instances Low-risk investment: 2 instances Diversification: 2 instances Regular income: 2 instances Meta description: Invest in TLT ETF, a low-risk option that provides regular income and diversification benefits. Learn more about the iShares 20+ Year Treasury Bond ETF, including stock price, quote, and news. Header tags: H1: Investing in Long-Term Treasury Bonds: A Guide to TLT ETF H2: What is TLT ETF? H2: Benefits of Investing in TLT ETF H2: TLT Stock Price and Quote H2: News and Market Trends H2: Conclusion Image: An image of a graph showing the performance of TLT ETF over time, or a picture of a person holding a tablet with a financial chart on the screen.